Blackrock Funds Capital Gains Estimates 2024

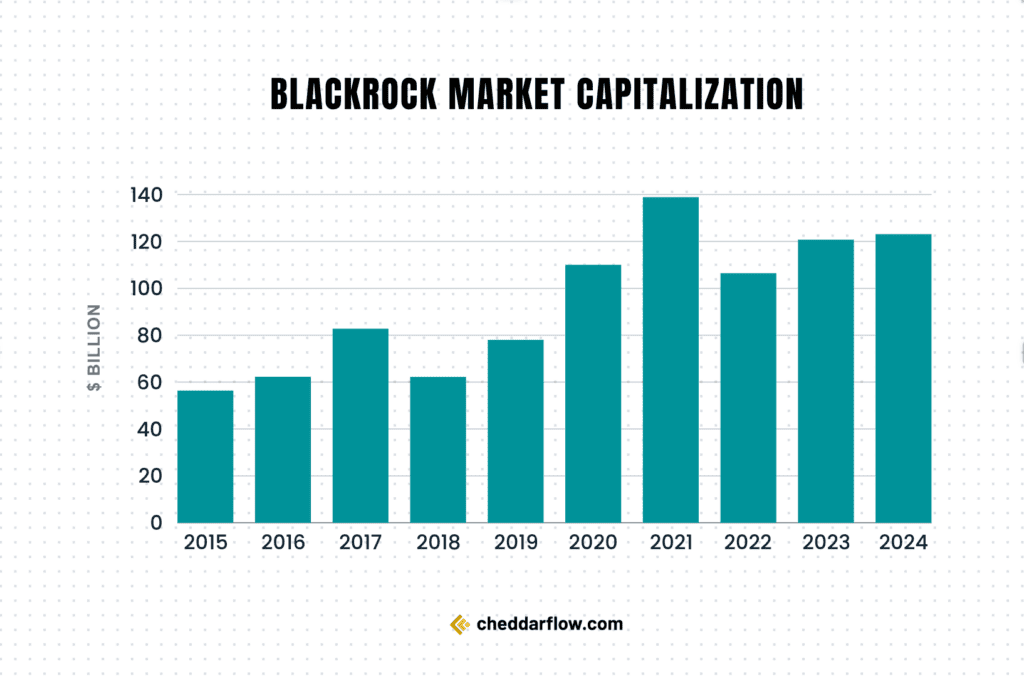

The shadow of potential capital gains distributions looms large for BlackRock fund investors as 2024 draws to a close. Uncertainty surrounds the final amounts, leaving investors to navigate a complex landscape of market fluctuations and fund management strategies. The estimates released by BlackRock offer a preliminary glimpse, but the ultimate impact on individual portfolios remains to be seen.

At the heart of this issue is the potential tax liability triggered by capital gains distributions from mutual funds and exchange-traded funds (ETFs). These distributions, representing profits realized from the sale of securities within the fund, are passed on to investors, even if they haven't sold any fund shares themselves. Investors need to understand the estimated capital gains distributions from BlackRock funds and consider their potential tax implications. This article unpacks the initial estimates, explores the factors driving these distributions, and provides guidance on how investors can prepare for potential tax liabilities.

Understanding Capital Gains Distributions

Capital gains distributions occur when a fund sells securities within its portfolio at a profit. These profits are then distributed to shareholders, typically at the end of the year. These distributions are taxable events, and investors are responsible for paying taxes on their share of the gains, regardless of whether they reinvest the distribution or take it as cash.

Several factors can contribute to capital gains distributions, including market volatility, fund inflows and outflows, and active portfolio management. Heavy trading within a fund, for instance, can lead to increased realized gains. Similarly, large redemptions can force a fund to sell appreciated assets, triggering capital gains.

BlackRock's Preliminary Estimates for 2024

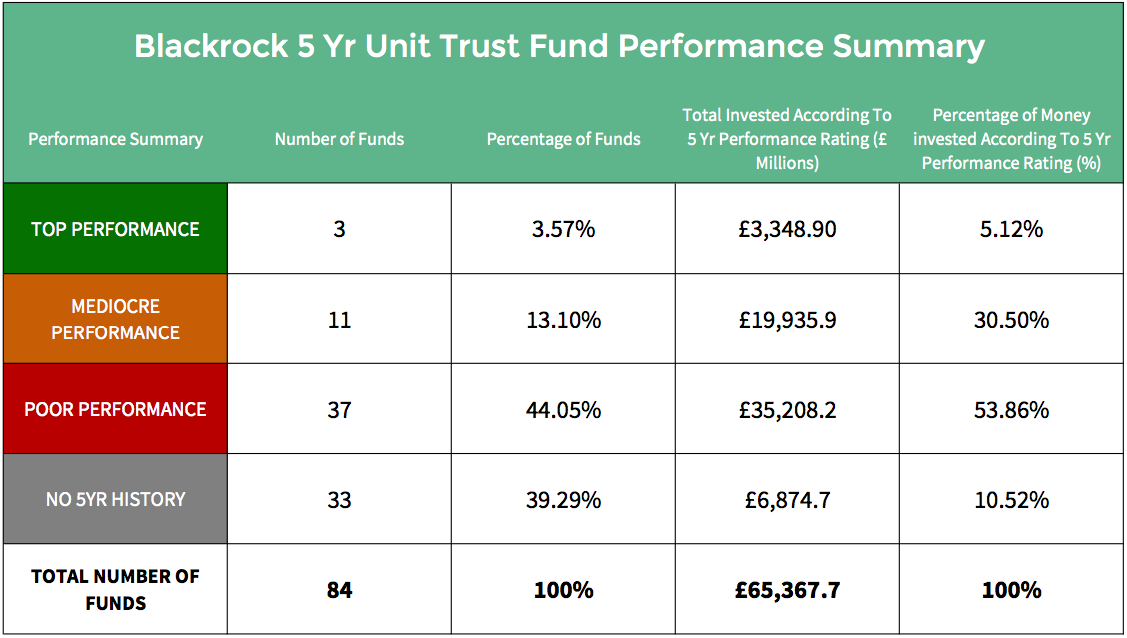

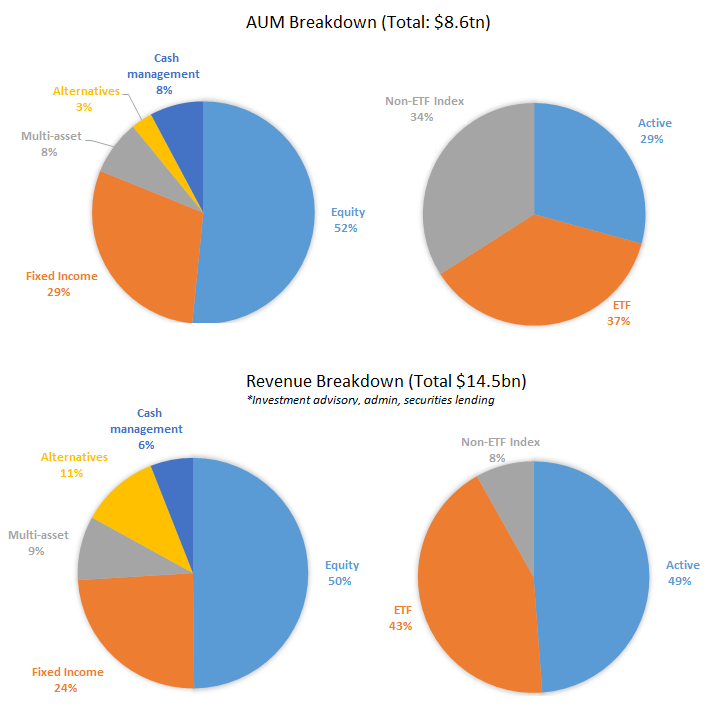

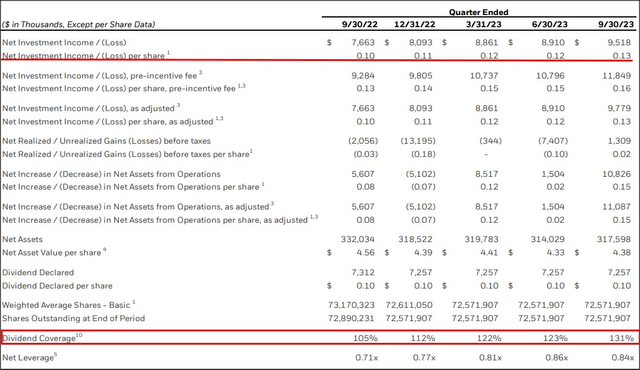

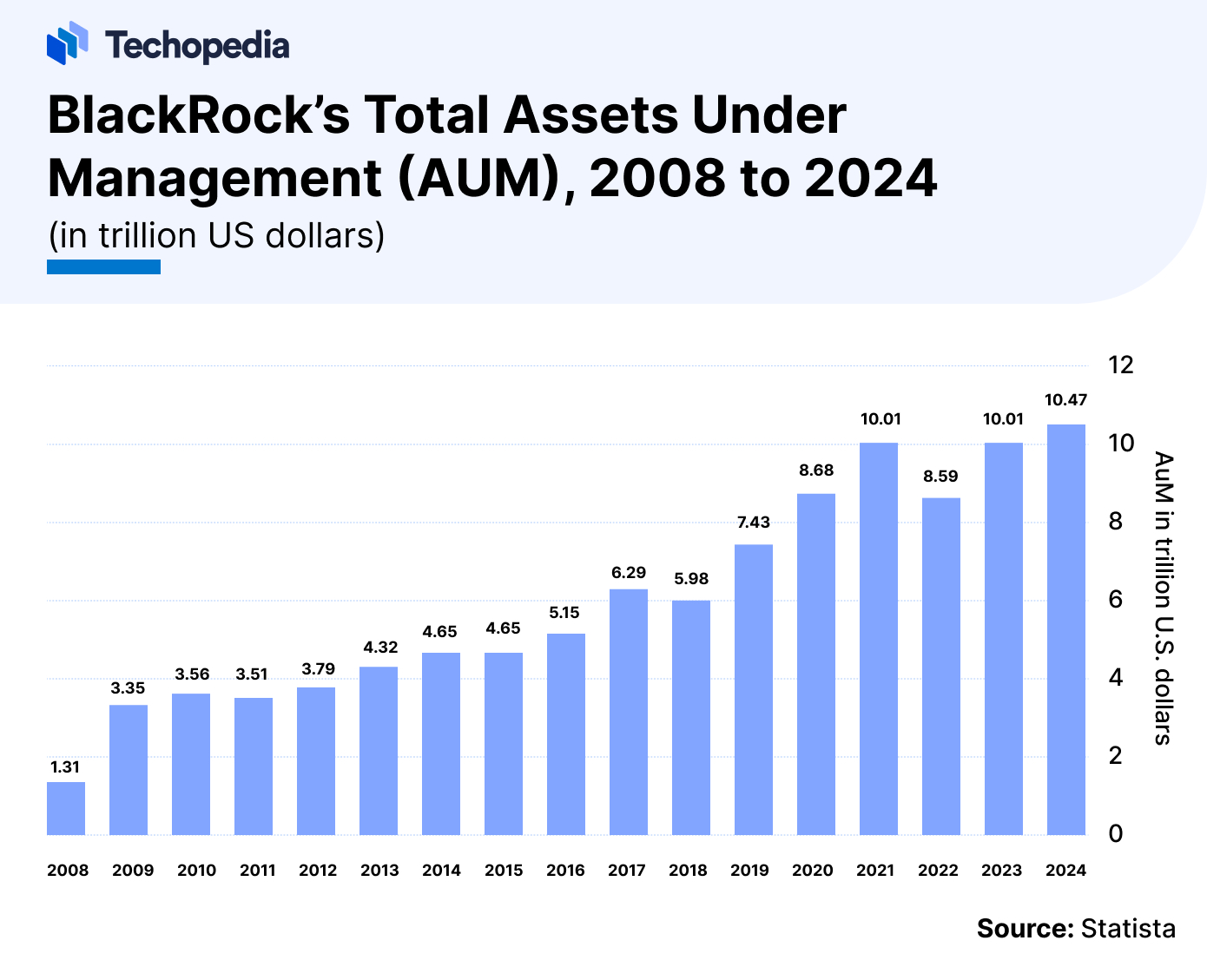

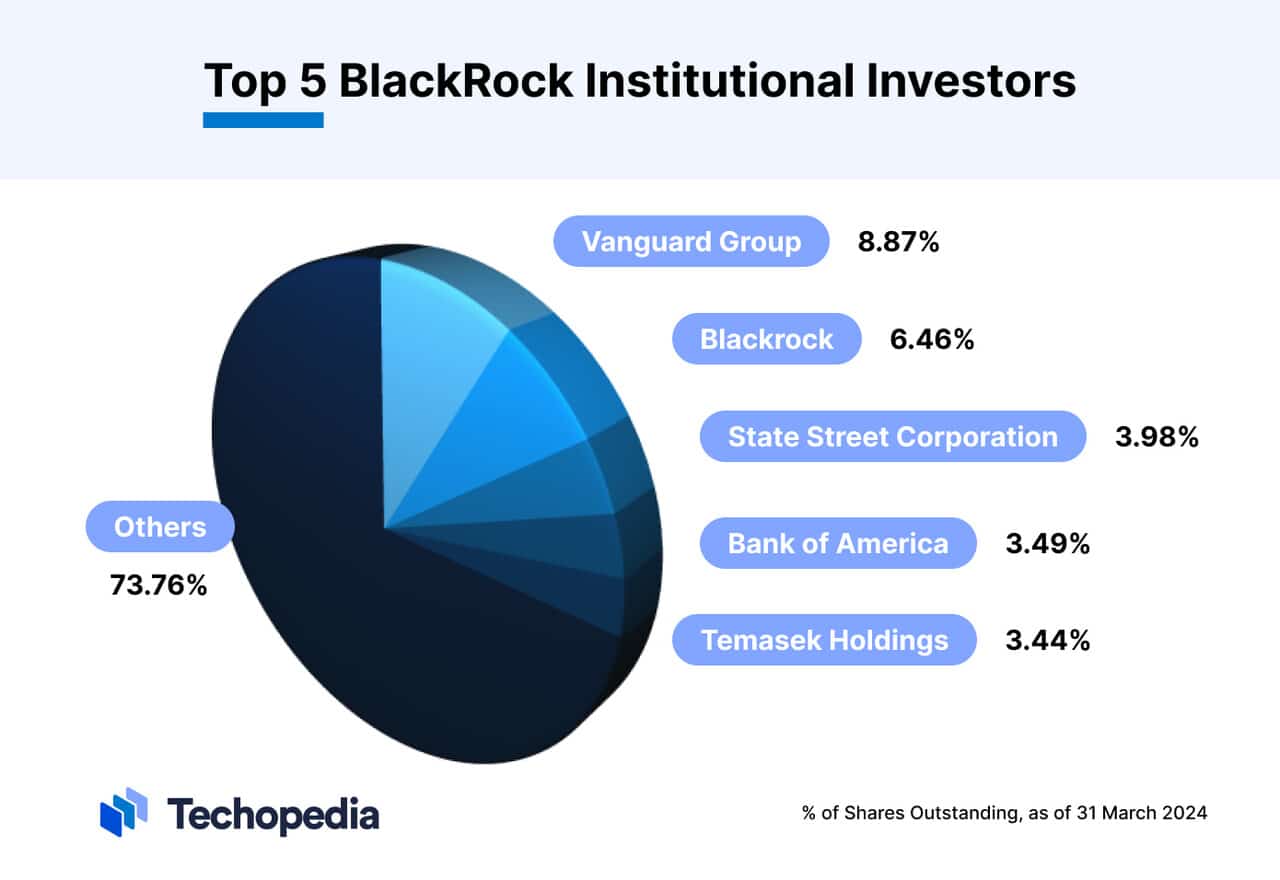

BlackRock, one of the world's largest asset managers, has released preliminary estimates for capital gains distributions across its fund lineup. These estimates provide a range, reflecting the inherent uncertainty in predicting market movements and fund activity in the remaining weeks of the year. The final amounts could be higher or lower than the initial estimates.

Analyzing these estimates requires careful consideration. Different funds will have varying distribution rates, depending on their investment strategy and portfolio turnover. Investors should consult BlackRock's official website or their financial advisor for specific information on the funds they own.

Factors Influencing the Estimates

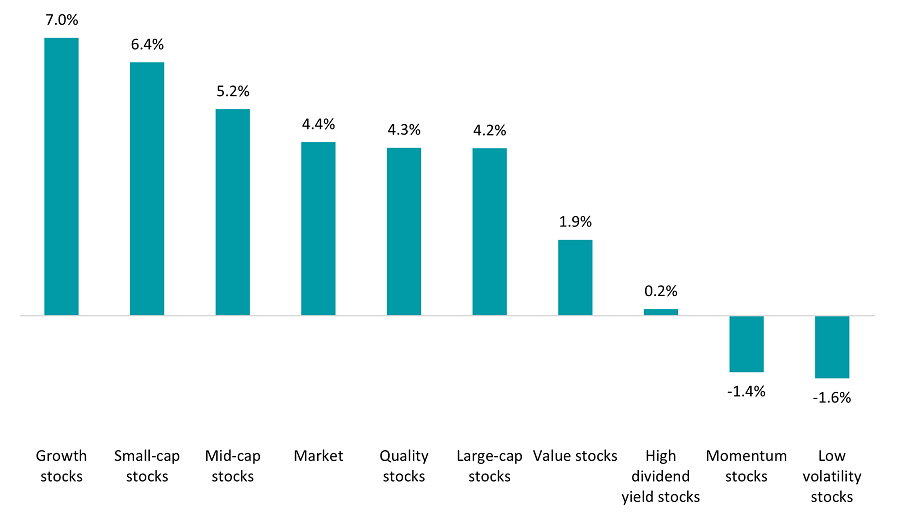

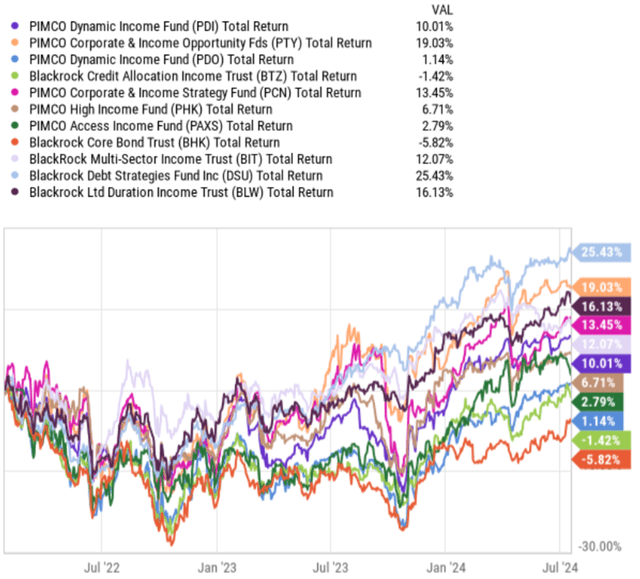

The market's performance throughout 2024 played a significant role in shaping these estimates. Periods of strong market gains likely resulted in increased realized profits within many funds. Conversely, volatile periods might have prompted portfolio adjustments, potentially leading to both realized gains and losses.

Fund flows, both inflows and outflows, also impacted the calculations. Large inflows can necessitate the purchase of new securities, while significant redemptions might force the sale of existing holdings. The balance between these flows directly influences the amount of realized gains or losses.

Impact of Active Management

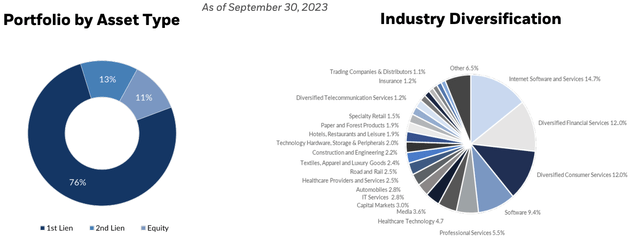

Actively managed funds, which involve frequent buying and selling of securities by fund managers, are more likely to generate capital gains distributions. This is because active management strategies often involve taking profits on successful investments. In contrast, passively managed index funds, which aim to track a specific market index, typically have lower turnover rates and, consequently, lower capital gains distributions.

Investors in actively managed BlackRock funds should pay particularly close attention to the estimated distributions. Understanding the fund's investment style can help anticipate the potential for capital gains.

Investor Strategies for Managing Capital Gains

While investors cannot avoid capital gains distributions entirely, they can take steps to manage their tax impact. One strategy is to hold mutual funds and ETFs in tax-advantaged accounts, such as 401(k)s or IRAs. Within these accounts, capital gains are not taxed until withdrawal during retirement.

Tax-loss harvesting is another technique that can help offset capital gains. This involves selling investments that have incurred losses to reduce the overall tax burden. However, investors should be mindful of the "wash sale" rule, which prevents them from repurchasing the same or substantially similar securities within 30 days of selling them at a loss.

Consider the Tax Efficiency of Funds

Before investing in a fund, investors should consider its historical tax efficiency. Some funds are managed with a greater emphasis on minimizing capital gains distributions than others. Reviewing a fund's prospectus and talking to a financial advisor can provide insights into its tax efficiency.

Expert Perspectives and Analysis

Financial advisors emphasize the importance of proactive tax planning. They advise investors to review their portfolios and consult with a tax professional to understand the potential impact of capital gains distributions. Ignoring these distributions can lead to unexpected tax liabilities and potentially disrupt long-term financial plans.

According to Morningstar, the magnitude of capital gains distributions can vary significantly from year to year, making it crucial for investors to stay informed. Morningstar also recommends assessing the tax efficiency of different funds before making investment decisions.

Looking Ahead: Final Distributions and 2025

The final capital gains distributions for BlackRock funds will be announced in December. Investors should monitor these announcements closely and adjust their tax planning strategies accordingly. Remember that the estimates are just that – estimates. The final distributions could deviate based on market conditions and fund activity in the remaining weeks of the year.

As we look ahead to 2025, investors should continue to prioritize tax-efficient investing strategies. Diversifying across asset classes and utilizing tax-advantaged accounts can help minimize the long-term impact of capital gains taxes. Consulting with a financial advisor is crucial to developing a personalized investment plan that aligns with individual financial goals and tax circumstances.

Understanding capital gains distributions is an essential part of responsible investing. By staying informed and proactive, investors can navigate the complexities of the market and minimize their tax liabilities. BlackRock's preliminary estimates provide a starting point, but diligent monitoring and professional advice are key to ensuring a smooth financial journey.