How To Send Money On Moncash

In Haiti, MonCash has emerged as a leading mobile money platform, revolutionizing how individuals and businesses conduct financial transactions. Understanding how to effectively utilize MonCash for sending money is crucial for navigating the increasingly digital Haitian economy.

This article provides a comprehensive guide on sending money via MonCash, detailing the process, security measures, and potential benefits for users.

Understanding the Basics of Sending Money on MonCash

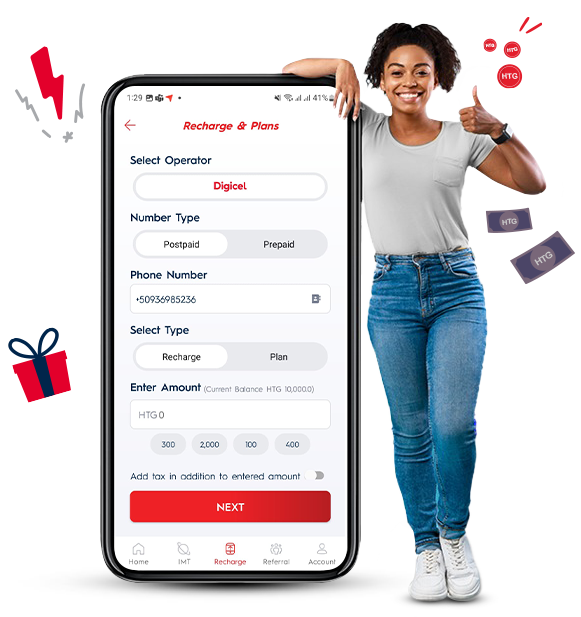

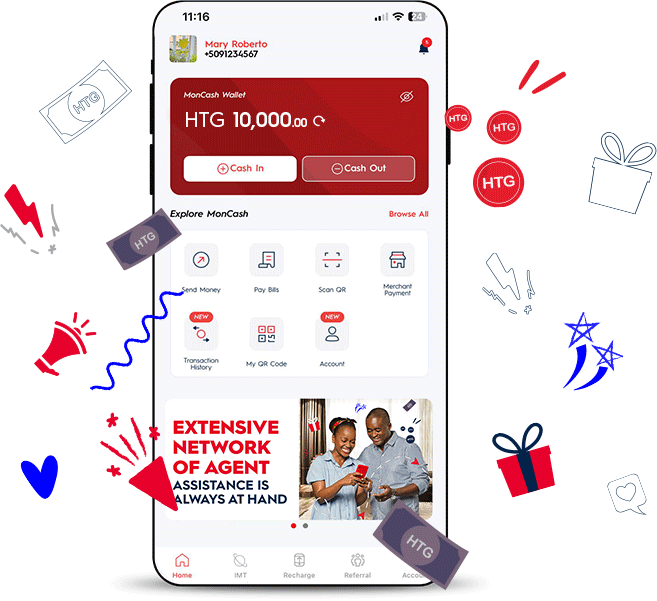

MonCash, operated by Digicel Haiti, allows users to send and receive money directly from their mobile phones. The service eliminates the need for traditional banking infrastructure, making financial transactions more accessible, especially in areas with limited banking presence.

To send money, both the sender and receiver need to be registered MonCash users.

Registration and Account Setup

To register for MonCash, individuals typically need to visit a Digicel store or an authorized MonCash agent. They will need to provide a valid form of identification, such as a national ID card or passport, and their Digicel mobile phone number.

Upon registration, users receive a PIN, which is essential for authorizing transactions. Keeping this PIN secure is critical to preventing unauthorized access to the MonCash account.

The Step-by-Step Process of Sending Money

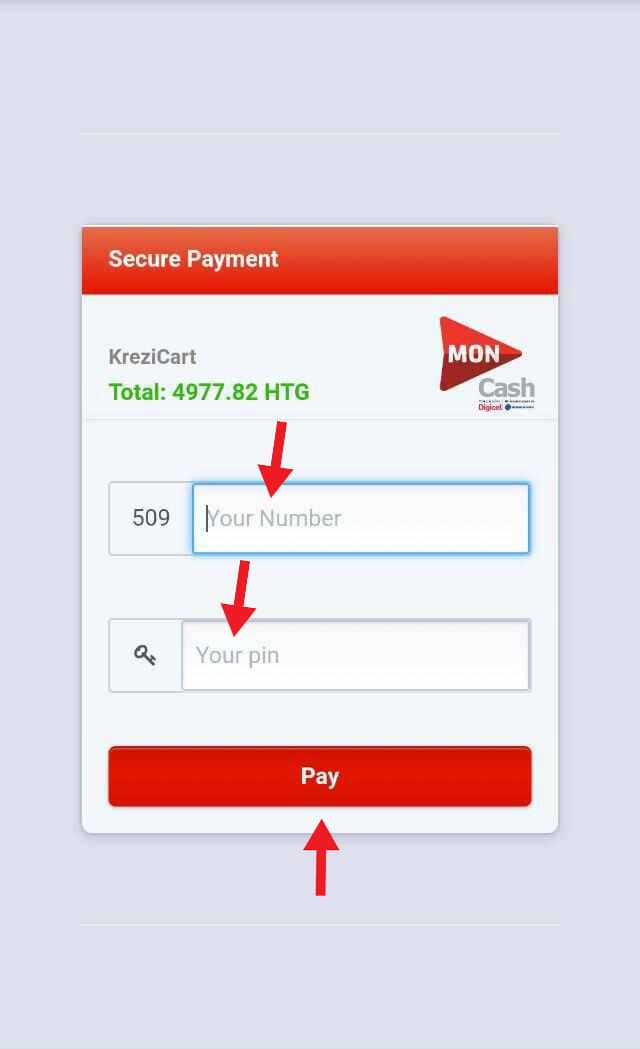

To send money using MonCash, users generally follow these steps: dial *202# on their Digicel mobile phone. Select the option to send money from the displayed menu.

Enter the recipient's mobile phone number and the amount to be sent. Confirm the transaction details and enter your MonCash PIN to authorize the transfer.

Both the sender and receiver will receive SMS confirmation messages once the transaction is complete.

Fees and Transaction Limits

MonCash transactions may incur fees, which vary depending on the amount being sent. Digicel Haiti publishes the fee structure on its website and through its customer service channels.

Transaction limits are also in place to prevent fraud and money laundering. These limits may vary depending on the user's account type and transaction history. Check the official MonCash website or contact customer service for up-to-date information on transaction limits and fees.

Security Measures and Best Practices

Security is paramount when using mobile money services. MonCash employs several security measures to protect users' funds and personal information.

These measures include PIN-based authorization, transaction monitoring, and encryption of data. Users are strongly advised to keep their PIN confidential and to avoid sharing it with anyone.

Tips for Safe MonCash Transactions

Always double-check the recipient's phone number before sending money to avoid sending funds to the wrong person. Be wary of phishing scams and fraudulent messages requesting your MonCash PIN or personal information.

Regularly review your MonCash transaction history to identify any unauthorized activity. Report any suspicious activity to Digicel Haiti's customer service immediately.

Consider setting strong and unique PIN, and change the PIN periodically to enhance security.

The Impact of MonCash on the Haitian Economy

MonCash has had a significant impact on the Haitian economy by facilitating financial inclusion and reducing reliance on cash transactions. It enables individuals and businesses to participate in the digital economy, even without traditional bank accounts.

The platform also facilitates remittances from abroad, providing a convenient and cost-effective way for Haitians living overseas to send money to their families and loved ones.

MonCash promotes entrepreneurship by enabling small businesses to accept payments electronically, expanding their customer base and streamlining their operations.

"MonCash has transformed the way we do business. It's safer and easier than handling cash," says Marie, a small business owner in Port-au-Prince.

MonCash and Humanitarian Aid

During times of crisis and natural disasters, MonCash has proven to be a valuable tool for delivering humanitarian aid to affected populations. Aid organizations can use the platform to distribute cash assistance directly to beneficiaries, ensuring that aid reaches those who need it most quickly and efficiently.

This reduces the risk of theft and corruption associated with traditional cash distributions and allows for greater accountability in aid delivery.

Conclusion

MonCash has become an indispensable tool for sending money in Haiti, providing a safe, convenient, and accessible alternative to traditional banking services. By understanding the registration process, transaction procedures, and security measures, users can effectively leverage MonCash to manage their finances and participate in the digital economy.

As mobile money adoption continues to grow in Haiti, MonCash is poised to play an even greater role in promoting financial inclusion and economic development throughout the country.

Embracing digital payment solutions like MonCash offers a path toward greater financial security and economic opportunity for all Haitians. This article provides a starting point for anyone wishing to navigate the world of mobile money in Haiti using the MonCash platform.

![How To Send Money On Moncash Welcome [brochure-uat.mc.moncashdfs.com]](https://brochure-uat.mc.moncashdfs.com/assets/files/home/slider/send-cash.png)