Northwestern Financial Advisor Salary

The promise of a lucrative career as a financial advisor lures many to Northwestern Mutual, but the reality of compensation can be complex and vary significantly. While top performers can achieve impressive earnings, many face a challenging initial period with inconsistent income, leading to debate about the true potential and sustainability of this career path at the firm.

This article delves into the multifaceted topic of Northwestern Mutual financial advisor salaries, examining the different compensation structures, factors influencing earnings, and the experiences of advisors at various stages of their careers. By analyzing available data, testimonials, and industry insights, it aims to provide a comprehensive understanding of the financial realities associated with this role and offer a balanced perspective for those considering this career path.

Compensation Structure: A Commission-Based Foundation

Northwestern Mutual's financial advisor compensation is primarily commission-based. This means that advisors earn income based on the products they sell, such as life insurance, annuities, and investment products.

Unlike some firms that offer a base salary in addition to commissions, many Northwestern Mutual advisors start with little to no guaranteed income. This reliance on commissions can create financial uncertainty, particularly in the early stages of their career.

Factors Influencing Earnings

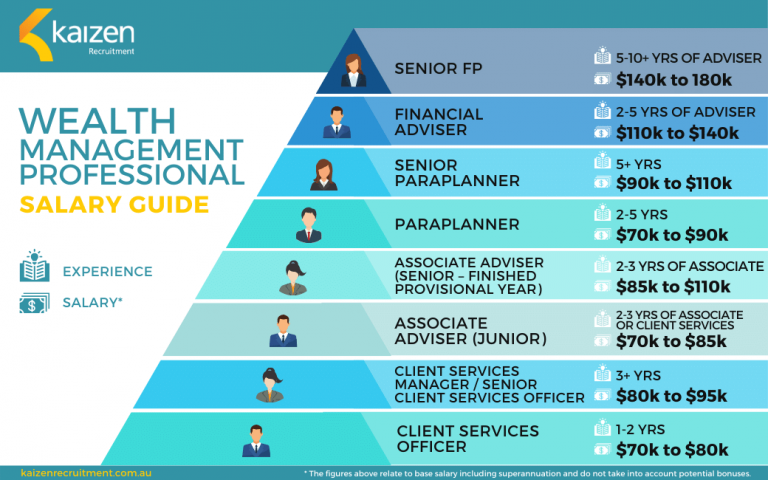

Several factors contribute to the wide range of salaries reported by Northwestern Mutual financial advisors. Experience level plays a crucial role; new advisors typically earn less than seasoned professionals with established client bases.

Client acquisition is another significant driver of income. Advisors who are effective at generating leads and building relationships will naturally earn more.

Product mix also impacts earnings. Certain products offer higher commission rates than others, so advisors who focus on selling these products may see a boost in their income.

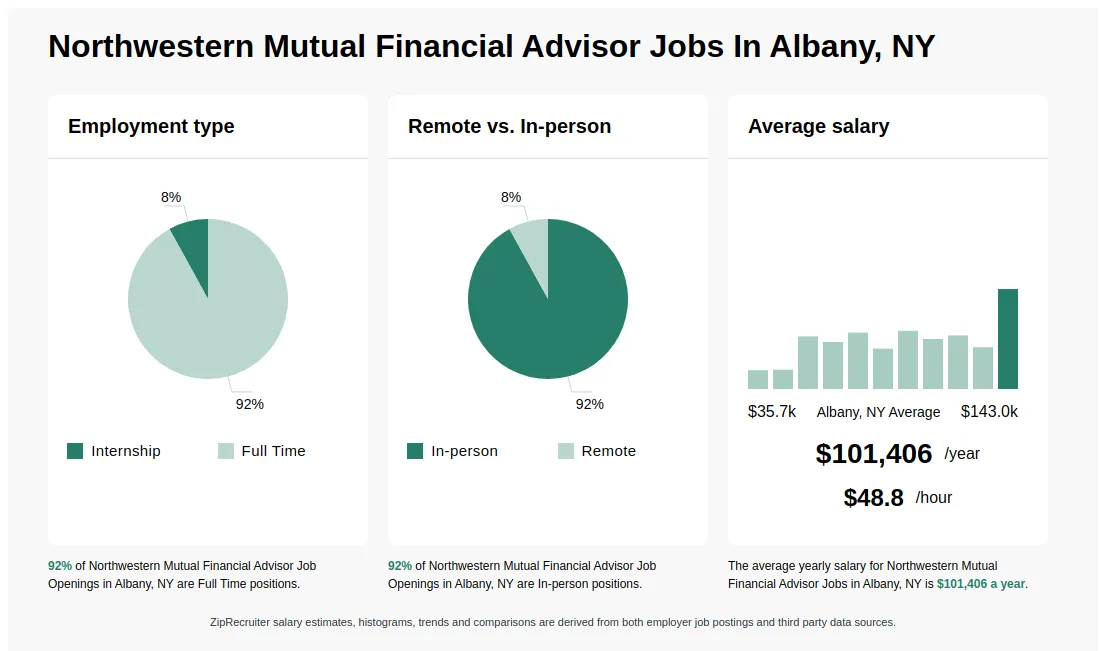

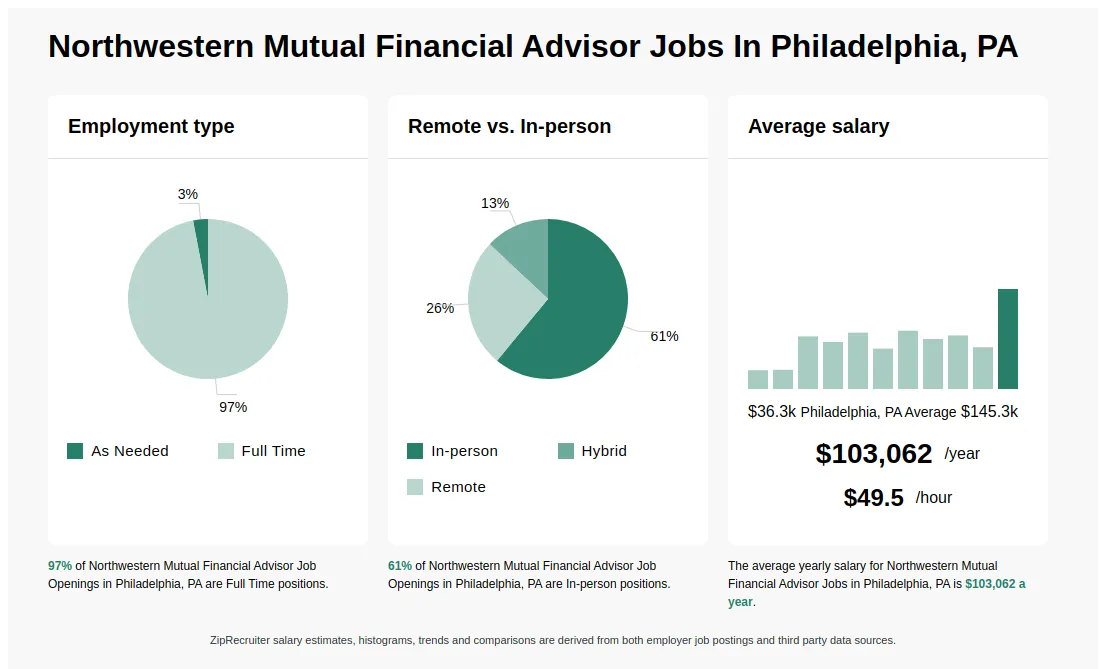

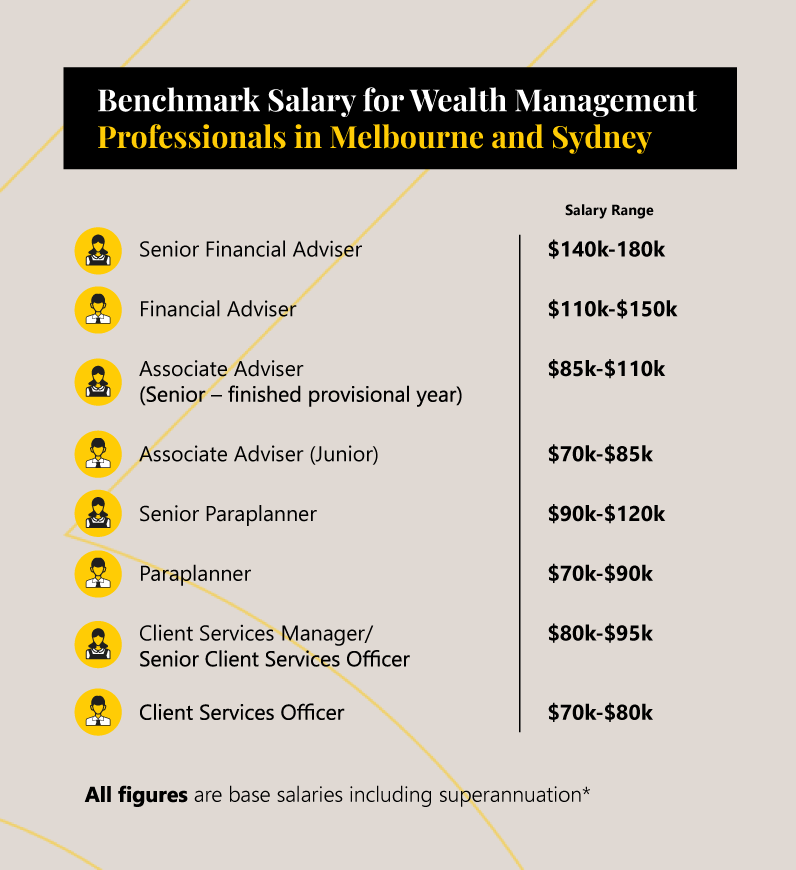

Geographic Location

The geographic location of an advisor's practice can also affect their earnings. Advisors in affluent areas with a higher demand for financial services may have more opportunities to generate income.

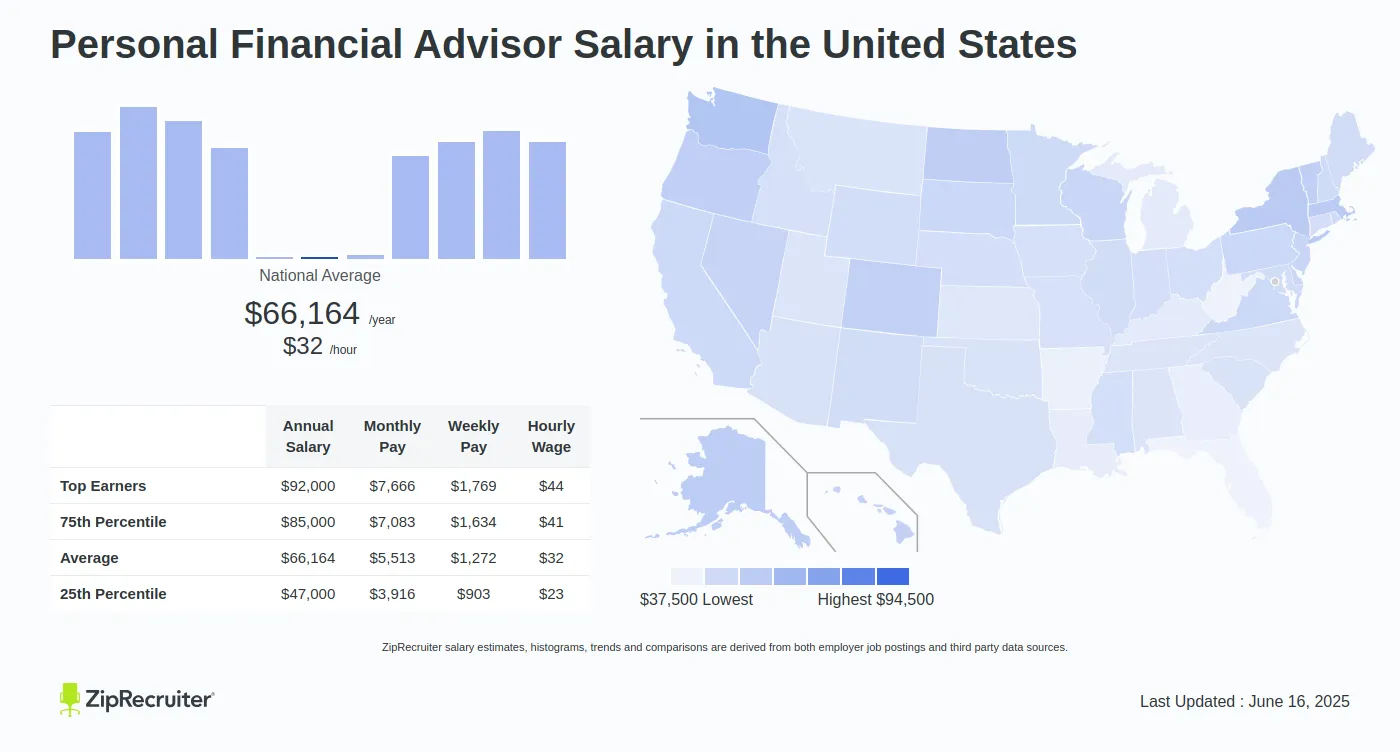

Data and Salary Ranges

Determining precise salary figures for Northwestern Mutual financial advisors is challenging due to the company's commission-based structure and the fact that advisors are considered independent contractors. Publicly available data sources provide varying estimates.

Glassdoor reports an average salary of around $94,000 per year, but this figure includes a wide range of reported salaries. Some advisors report earning significantly less, especially in their early years.

Other sources, like Payscale, offer similar ranges, often highlighting the potential for high earnings for top performers but acknowledging the lower end of the spectrum for those starting out. It is important to note that these figures are self-reported and may not represent the entire advisor population.

The Advisor Experience: Challenges and Opportunities

The initial years as a Northwestern Mutual financial advisor can be challenging. Building a client base requires significant effort, and income can be unpredictable.

However, successful advisors who persevere can build a thriving practice with substantial earning potential. Many find satisfaction in helping clients achieve their financial goals.

"The first few years were tough, but the support and training I received from Northwestern Mutual were invaluable," says Sarah Miller, a successful advisor with over 10 years of experience. "It's not easy money, but the rewards are worth the hard work."

Perspectives on Compensation

There are varying perspectives on the compensation structure at Northwestern Mutual. Some view the commission-based system as a fair way to reward high performers.

Others argue that it puts undue pressure on advisors to sell products, potentially compromising client needs. Concerns have also been raised about the high attrition rate among new advisors, suggesting that the initial financial challenges are too great for many.

Northwestern Mutual emphasizes the comprehensive training and support provided to its advisors, highlighting the opportunity to build a long-term, sustainable business. They maintain that their model allows ambitious individuals to control their own earning potential.

The Future of Financial Advisor Compensation

The financial advisory industry is evolving, with increasing scrutiny on compensation practices and a greater emphasis on fee-based models. While Northwestern Mutual remains committed to its commission-based structure, it is important to monitor how these industry trends may impact advisor compensation in the future.

Potential advisors should carefully consider the financial realities of this career path, including the initial challenges and the reliance on commission-based income. Thorough research, networking with current advisors, and a realistic assessment of one's sales skills are crucial for making an informed decision.

Ultimately, success as a Northwestern Mutual financial advisor requires dedication, perseverance, and a genuine commitment to serving clients' financial needs. While the financial rewards can be significant, it is essential to enter this career path with a clear understanding of the challenges and opportunities that lie ahead.